About MEFIC REIT

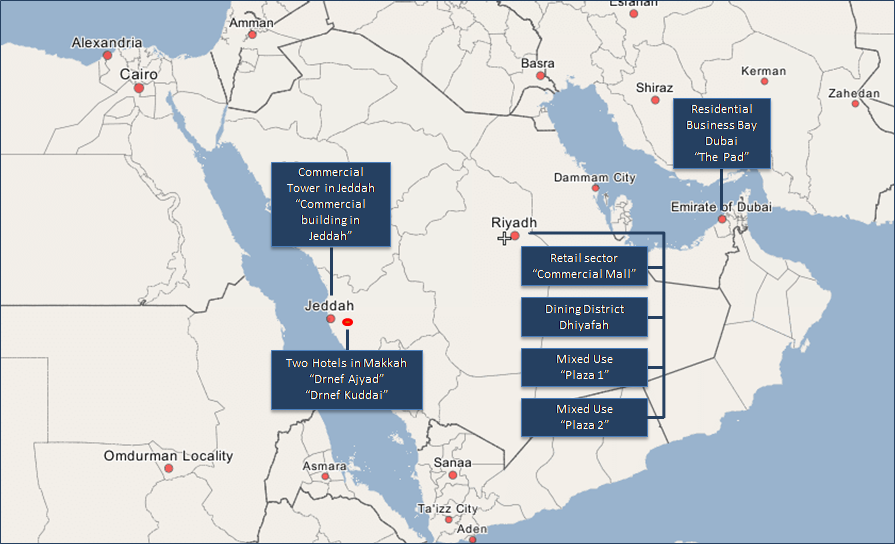

“MEFIC REIT” fund is a shariah-compliant close-ended traded real estate investment fund to be listed on the Saudi Capital Market (Tadawul). The fund, which is licensed by the Capital Market Authority, secured the approval for its public offering on 26/3/2018G corresponding to 9/7/1439H. MEFIC REIT is one of the largest listed REITs in Tadawul with a fund size of SAR1.23bn distributed over 123 million units. MEFIC REIT’s portfolio composed of 8 properties distributed in three main cities in KSA (Riyadh, Jeddah and Makkah) in addition to Dubai in UAE.

MEFIC REIT is the only listed REIT that provides a committed minimum return to its subscribers in KSA. We highlight that 6 properties (out of 8) in MEFIC REIT are leased through binding guaranteed triple net lease contracts to master tenants for 4 years, which will reduce the operational and rents collection risks. Moreover, MEFIC REIT is one of the most diversified listed REITs in term of geographic locations and sectors coverage (Residential, Retail, Office, and Hospitality).

Fund Objective

MEFIC REIT aims to generate income on the invested capital by acquiring a number of recurring income-generating real estate assets in KSA and GCC.

More focus on the advantage of “Committed Minimum Return”

MEFIC REIT aims to provide a return of 7.5% in 2018 with expectation to reach 7.9% in 2021. In addition to this, MEFIC REIT intends to provide a minimum threshold return of 5% (floor). In a situation where the return falls below the minimum threshold, MEFIC Capital, as the REIT’s manager would infuse to a maximum extent of 2% (commitment), thereby aiming to bring the return to 5% for a period of 8 years.

MEFIC REIT Facts

| Fund Name | MEFIC REIT fund |

| Fund Manager | Middle East Financial Investment Company (MEFIC Capital) |

| Fund Currency | Saudi Riyal (SAR) |

| Fund Duration | 99 years |

| Fund Size | SAR1,230mn, distributed over 123 million units |

| Offering size | SAR879.5mn, distributed over 87.95 million units |

| Subscription period | 4 April 2018 to 15 May 2018 |

| Offer price | SAR10/unit |

| Subscription fees | 2% of subscription amount |

| Qualified investors | Considering the rules governing the ownership of properties by non-Saudis, subscription into “MEFIC REIT” is available for the following: – – Natural persons who are the citizens of Saudi Arabia. |

| Minimum subscription | 50 units which is equal to SAR 500 |

| Maximum subscription | 6,149,950 units which is equal to SAR 61,499,500 |

| Receiving banks | MEFIC Capital, Al Rajhi Bank, NCB, Riyadh Bank, Banque Saudi Fransi and Aljazira Capital |

| Initial gross yield on fund size | 7.97% |

| Initial net yield on fund size | 7.5% |

| Profit distribution | Semi-Annual distribution of at least 90% of the fund’s net profit |

MEFIC REIT Properties

Please refer to the full Terms & Conditions

| Disclaimer The Fund Investment value is volatile -not fixed-, the investment value may increase or decrease, moreover, the fund investment value and/or the unit prices and/or income may witness a decrease in value, as a result the Investor may receive a lower amount than the principle invested amount. Please refer back and read the Fund Terms and Conditions in general and practically the related information concern performance fess and risks that associated when investing at the Fund. If you have any doubt about the suitability of this instrument/investment to you, consult your investment counselor. |

Annual Report – MEFIC REIT Fund 2021

Annual Report – MEFIC REIT Fund 2020

Annual Report – MEFIC REIT Fund 2019

Annual Report – MEFIC REIT Fund 2018

REIT Quarter Report Q1 2023

REIT Quarter Report Q1 2022

REIT Quarter Report Q1 2021

REIT Quarter Report Q1 2020

REIT Quarter Report Q1 2019

REIT Quarter Report Q2 2023

REIT Quarter Report Q2 2022

REIT Quarter Report Q2 2021

REIT Quarter Report Q2 2020

REIT Quarter Report Q2 2019

REIT Quarter Report Q3 2023

REIT Quarter Report Q3 2022

REIT Quarter Report Q3 2021

REIT Quarter Report Q3 2020

REIT Quarter Report Q3 2019

REIT Quarter Report Q4 2022

REIT Quarter Report Q4 2021

REIT Quarter Report Q4 2020

REIT Quarter Report Q4 2019